Are Pension Drawdown Calculators a Thing of the Past?

Quick history of how I stumbled upon Pension Drawdown Calculators A few years back, one of my close friends (let’s call him John) was inching

Welcome to Pension Drawdown Calculator, the UK's leading pension drawdown calculator for UK pensions and retirement. Simply enter your lump sum amount, the age at which you would like to start withdrawals, and any other earnings including annuity and investments and we will calculate your accrued pension earnings.

![]()

Enter your pension pot, choose a lump sum, set your ages, pick an annual withdrawal method, define leftover growth, and optionally buy an annuity or invest. We'll do the rest.

£0

Over 25% lumpsum triggers extra tax considerations & limited annual contributions (max £10k).

Age you want to start drawing your pension. Not lump sum.

Additional Investments in Your Pension

£0

£10,000

3%

Enter a £ figure, or switch to a % of annuity cost.

0 years

£0

You are investing more than your lumpsum net. We'll treat the excess as external funds.

10 years

0%

Illustrative only, not financial advice. Real taxes & fees vary.

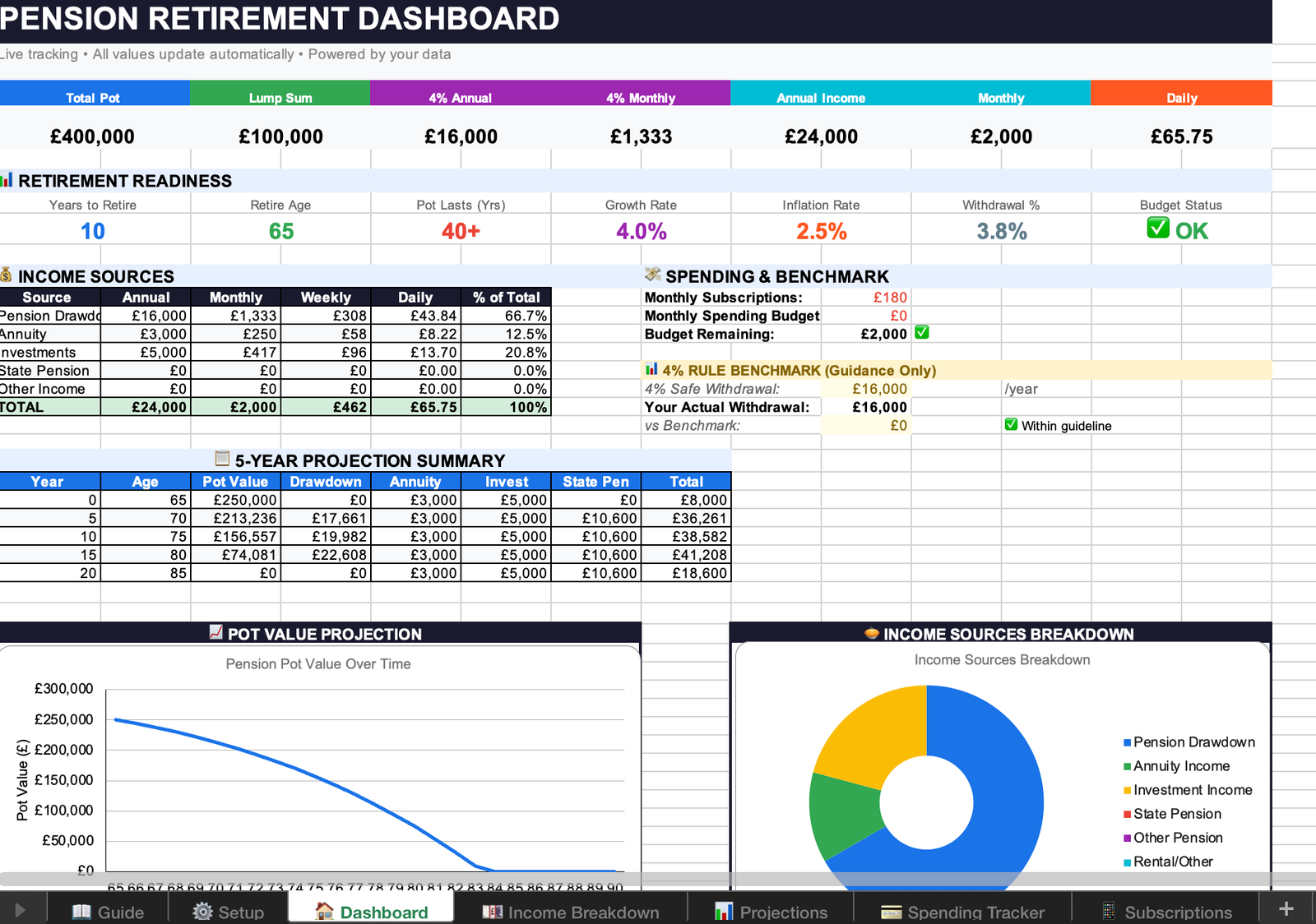

Get a comprehensive Excel dashboard to track your pension journey:

One-time purchase. Instant access via Excel.

| Year | Age | Withdrawal | Remaining Pot |

|---|

The information in this chart is only based on the information you have provided and real withdrawal amounts may differ depending on real inflation rates, fees, and other factors. If you need accurate and personal financial advice, please contact a financial advisor.

Quickly get the latest Pension information & updates on new retirement planning support.

Access from anywhere to quickly calculate your pension drawdown whether on a a beach or at home.

Calculate how your withdrawal will impact your long-term savings goals and aspirations.

Not tech-savvy? No problem. We have designed pension drawdown calculator as a simple and easy to use solution to calculate your pension drawdown.

Pension drawdown is a way of taking money from your retirement savings while keeping the rest invested, giving you more control over how and when you access your funds. Instead of cashing out your entire pension in one go or locking yourself into an annuity (which provides a fixed income), drawdown lets you dip into your pension pot as needed while hopefully benefiting from continued investment growth.

With flexi-access drawdown, you can take up to 25% of your pension tax-free, usually as a lump sum, and then withdraw from the rest whenever you like. The catch? Any further withdrawals are taxed as income, so it’s worth thinking about how much you take and when. Unlike an annuity, where your income is fixed for life, drawdown gives you the flexibility to adjust your withdrawals depending on your lifestyle, investment performance, and tax situation.

The upside? You get more freedom and potential for growth. The downside? Your pension remains exposed to market ups and downs, meaning if your investments take a hit or you withdraw too much too soon, you could run out of money earlier than expected. That’s why it’s important to plan carefully—balancing withdrawals, keeping an eye on investment performance, and considering ways to make your pension last. Done right, drawdown can give you both financial security and the flexibility to enjoy retirement on your terms.

Quick history of how I stumbled upon Pension Drawdown Calculators A few years back, one of my close friends (let’s call him John) was inching

Sequence Risk: Why Timing Your Pension Matters More Than You Think Picture this: You’ve worked hard for decades, built up a solid pension pot, and

Introduction: Understanding the MPAA Rule The Money Purchase Annual Allowance (MPAA) is an important pension rule in the UK that limits how much you can

What is a Dynamic Withdrawal Strategy for Pension Drawdown? A dynamic withdrawal strategy is a flexible approach to withdrawing money from your retirement savings. Unlike

The 4% Rule Explained If you’re planning for retirement and wondering how much you can safely withdraw from your pension each year without running out

Why Inflation Matters in Retirement Inflation is often referred to as the “silent thief of wealth,” and for retirees relying on pension drawdown, it can

Recognised for innovation and ease of use, Pension Drawdown Calculator sets the standard for quick and retirement and pension calculations for UK pensioners and retirees. Join the thousands who trust us for fast and secure calculations.

A pension drawdown calculator is a completely free tool for UK retirees & investors to calculate their pension withdrawals and remaining savings. Whether you are planning your retirement income or already drawing down from your pension, this calculator will help you estimate how much you have, or could have, over time.

We made pension drawdown calculator easily accessible to retirees (and potential retirees) in the easiest possible way - online. We may develop an app in future so watch this space! To check out more pension drawdown calculators click the link below.

Yes, while we take both annuity and investment income into account for your entire pension savings we do not claim to be an annuity calculator and you may find discrepancies between your annuity provider's agreements and our calculations. Always do your own research.

If you want to get in touch with us for any reason, feel free to message us on info@pensiondrawdowncalculator.com - we are happy to speak to you or any any questions about the site.

Managing your pension drawdown wisely can make a huge difference to your financial security in retirement. Taking out too much too soon could mean running out of money earlier than expected, while withdrawing too little might mean not fully enjoying the retirement you’ve worked for.

A well-planned drawdown strategy helps balance your income needs with the long-term sustainability of your pension. Even small adjustments—like withdrawing a little less during market downturns or considering tax-efficient withdrawals—can help your money last longer. With the right approach, you can enjoy a comfortable retirement without the worry of your savings running out too soon.

Pension drawdown is calculated based on several key factors:

Withdrawal Amounts – The more you withdraw, the faster your pension pot will deplete. Adjusting withdrawals to match your needs and market conditions can help stretch your savings.

Investment Growth – If your pension remains invested, its value can rise or fall depending on market performance. A well-balanced investment strategy can help maintain your fund over time.

Tax Considerations – The way you withdraw your pension affects how much tax you pay. The first 25% is usually tax-free, but anything beyond that is subject to income tax, which could impact your overall retirement income.

Longevity Planning – Your expected lifespan plays a role in determining sustainable withdrawals. Calculators estimate how long your pension might last based on different withdrawal rates and growth assumptions.

By considering all these factors, you can create a drawdown plan that provides steady income while keeping your pension working for you as long as possible.

If you’re wondering how long your pension will last or how much you can safely withdraw, a Pension Drawdown Calculator can take the guesswork out of planning. Simply enter details like your pension pot size, expected investment returns, and withdrawal amount, and the calculator will estimate how long your funds could last.

A good Pension Drawdown Calculator helps you explore different scenarios—adjusting withdrawals, factoring in market changes, and considering tax implications—so you can make informed decisions about your retirement income. With the right plan, you can balance enjoying your pension now while ensuring financial security for the future.

Annuity calculations estimate how much guaranteed income you will receive from your pension pot based on several key factors:

Purchase Amount – The size of your pension pot directly affects your annuity income. The more you invest in an annuity, the higher your regular payments will be.

Annuity Rate – This is the percentage used to determine your annual income. It depends on factors like interest rates, inflation, and life expectancy. For example, if annuity rates are 5% and you invest £100,000, you would receive around £5,000 per year.

Payment Frequency – Annuities can pay out monthly, quarterly, or annually. Choosing more frequent payments can help with budgeting, but it may slightly reduce each individual payment.

By considering these factors, our calculator estimates how much income you can expect alongside your pension drawdown.

Understanding how pension drawdowns are calculated is crucial for making sure your retirement savings last. Your withdrawal rate, investment growth, and tax implications all play a role in how long your pension pot will support you.

If you withdraw too much too soon, you risk running out of money later in life. On the other hand, a well-planned drawdown strategy can help balance your income needs while keeping your savings working for you. By adjusting withdrawals based on market conditions and tax efficiency, you can maximize your pension and enjoy a financially secure retirement.

The best pension drawdown calculators often feel like a breeze, simple to use, highly customisable and packed full or personal features, all without being too intrusive. Here are the best pension drawdown calculators in the UK (if you for some reason get sick of ours!)

These drawdown calculators, not only help you understand withdrawal rates but offer some really useful features as well. None, however, compare to the sheer depth and range of our pension drawdown calculator – we feature all kinds of features such as annuity planning, MPAA rules, the 4% rule, inflation retirement age (vs current age) and much more to provide you with the most comprehensive and realistic pension drawdown calculator in the UK.

Join the future of pension drawdown calculations today. With our secure & easy-to-use site, you can quickly calculate how, and if, your pension drawdown will impact your savings trajectory, all from your phone. Sign-up for all the latest pension & savings offers.